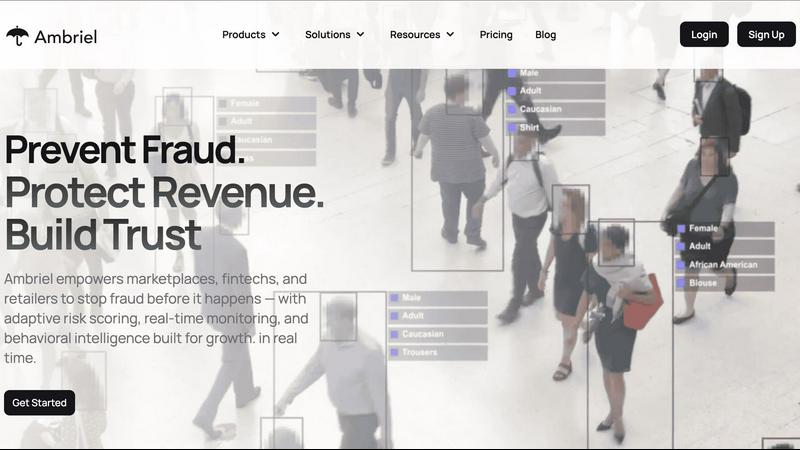

Ambriel

Ambriel's unified risk engine continuously evolves to detect and stop fraud in real time.

Visit

About Ambriel

Ambriel is an advanced fraud intelligence and risk management platform engineered for the modern digital business. It is built to help companies operate securely, comply with evolving regulations, and protect their users—all without introducing friction that could deter legitimate customers. Designed specifically for high-velocity sectors like fintech, marketplaces, retailers, and iGaming, Ambriel provides a powerful, unified ecosystem for comprehensive risk oversight. The platform's core value proposition lies in its ability to proactively detect, score, and prevent fraud before it can impact revenue or reputation. By continuously analyzing a rich tapestry of data—including user behaviors, device fingerprints, network signals, and transaction patterns—Ambriel uncovers hidden risk patterns and automates mitigation in real time. This cyclical process of learning and adapting ensures defenses grow smarter, turning every interaction into an opportunity to strengthen security. With Ambriel, organizations can confidently identify and stop sophisticated threats like multi-accounting, bonus abuse, synthetic identity creation, payment fraud, and money laundering, fostering a secure environment where trust and growth can flourish together.

Features of Ambriel

AI-Driven Risk Scoring & Detection

Ambriel's advanced fraud detection leverages behavioral analytics and data from over 200+ sources to generate real-time risk scores for every user and transaction. This AI-powered engine continuously learns from new patterns, iteratively improving its accuracy to spot suspicious activity like synthetic identities or payment anomalies before they result in financial loss, ensuring your protection mechanisms are always evolving.

Automated Sanctions & PEP Screening

Stay compliant effortlessly with automated screening against 100+ global sanctions, Politically Exposed Persons (PEP), and crime watchlists. This feature eliminates the need for slow, manual checks, providing continuous, up-to-date compliance monitoring that adapts to regulatory changes, helping you mitigate legal risk without slowing down your onboarding or transaction processes.

Continuous Behavioral Monitoring

Ambriel provides 24/7 surveillance of accounts and transactions, tracking for unusual patterns and behavioral shifts. The system sends proactive alerts on potential threats, allowing teams to intervene before suspicious activity escalates into a costly fraud case. This ongoing vigilance creates a feedback loop that constantly refines the understanding of normal versus malicious behavior.

Frictionless Onboarding Flows

Design and customize seamless user onboarding journeys integrated with automated trust and safety checks. Ambriel enables you to verify customers and sellers efficiently, blocking bad actors while allowing legitimate users to pass through without unnecessary hurdles. This iterative approach to onboarding balances security with user experience, building trust from the very first interaction.

Use Cases of Ambriel

Onboarding & Registration Fraud Prevention

Detect and prevent fake accounts, bot-driven signups, and sophisticated synthetic identity creation during the user registration process. Ambriel analyzes signals from devices, emails, and behavior to flag high-risk signups before they can exploit your platform, ensuring only trustworthy users are onboarded and reducing future fraud cycles.

Payment & Transaction Fraud Monitoring

Monitor real-time financial transactions to instantly spot anomalies, prevent fraudulent transfers, and reduce chargebacks. By scoring each transaction based on historical patterns and current risk signals, Ambriel helps block fraudulent payments while approving legitimate ones, protecting revenue in a continuous feedback loop of learning.

Bonus & Promotion Abuse Mitigation

Stop fraudsters who exploit promotional incentives through multi-accounting, referral scams, and other abuse techniques. Ambriel identifies linked accounts and anomalous reward-redemption patterns, allowing you to enforce fair use policies and ensure marketing budgets reward genuine customers, improving the effectiveness of each campaign iteration.

Account Takeover (ATO) Protection

Identify and respond to credential stuffing attempts, unusual login locations, and suspicious device changes that indicate account compromise. Ambriel's continuous monitoring safeguards user accounts by challenging high-risk access attempts, protecting both customer assets and your platform's reputation through adaptive security measures.

Frequently Asked Questions

What types of businesses is Ambriel designed for?

Ambriel is specifically built for digital businesses operating in high-risk, high-volume environments. Its primary users include fintech companies, digital marketplaces, e-commerce retailers, iGaming platforms, crypto exchanges, and insurance providers. Any business that needs to manage user trust, prevent financial fraud, and meet compliance requirements at scale will benefit from its adaptive platform.

How does Ambriel's real-time detection work without slowing down my service?

Ambriel is engineered for high performance and low latency. The platform processes and scores risk by analyzing data points from devices, behaviors, and networks in milliseconds. This happens seamlessly in the background via API integrations, allowing you to make instant "approve," "review," or "decline" decisions without adding perceptible friction to the user experience for legitimate customers.

Can Ambriel help with regulatory compliance like AML and KYC?

Absolutely. Ambriel is a foundational tool for compliance, featuring automated sanctions, PEP, and adverse media screening essential for Anti-Money Laundering (AML) programs. Its digital identity verification and risk scoring also streamline Know Your Customer (KYC) processes. The platform is designed to be GDPR ready and supports ongoing compliance through continuous monitoring and audit trails.

How does the platform adapt to new and evolving fraud tactics?

Ambriel employs a cyclical, iterative approach to improvement. Its AI models are continuously trained on new, anonymized global threat data and the specific patterns observed on your platform. This means the system learns from every blocked fraud attempt and analyzed transaction, constantly refining its detection algorithms to identify novel attack vectors and sophisticated, evolving fraud schemes.

You may also like:

Crowdstake AI

Crowdstake is an AI-powered web and marketing system that helps founders and teams launch beautiful, high-conversion websites.

apptovid

AI powered Promotional Video Maker that can directly turn URL to Video for apps

CIOOffice: the CIO-Software

CIOOffice is a centralized cloud platform for CIOs to manage IT strategy, budgets, projects, and vendor relationships...