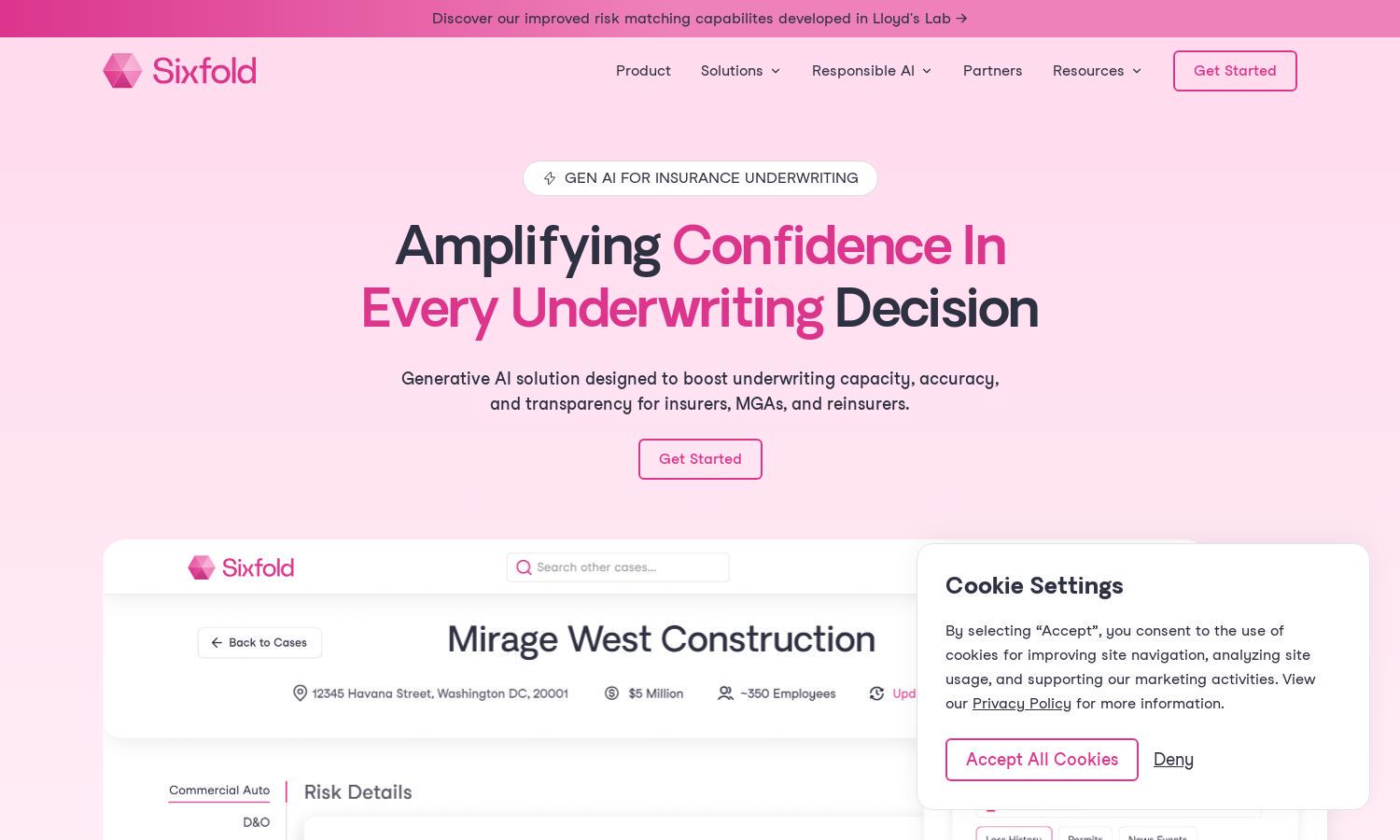

Sixfold

About Sixfold

Sixfold is dedicated to transforming the insurance underwriting process with cutting-edge generative AI tools. It simplifies complex tasks for underwriters, enhancing decision-making and operational efficiency. By providing transparent and tailored recommendations, Sixfold ensures compliance and empowers insurers to navigate risks effectively, improving overall underwriting outcomes.

Sixfold offers flexible pricing plans tailored to meet diverse underwriting needs. Each subscription tier provides valuable insights and automation capabilities, with premium options delivering enhanced features for larger organizations. Users benefit from cost-effective solutions designed to streamline workflows and improve risk management without compromising on quality or security.

The user interface of Sixfold is designed for seamless interaction, combining clarity with intuitive navigation. Its user-friendly layout allows underwriters to easily access features and information, enhancing productivity. With accommodating design elements, Sixfold ensures an efficient experience, making advanced underwriting insights accessible to users of varying technical expertise.

How Sixfold works

Users begin their journey with Sixfold by onboarding their underwriting guidelines into the platform. The AI model then ingests this information, extracting key data from submissions and supporting documents. As users navigate, Sixfold provides real-time recommendations and insights tailored to their risk appetite, ensuring transparency and seamless integration into existing workflows without the need for system overhauls.

Key Features for Sixfold

Automated Risk Recommendations

Sixfold's Automated Risk Recommendations harness generative AI to deliver tailored insights to underwriters. By processing extensive data, it identifies positive, negative, and disqualifying risk factors efficiently. This innovative feature allows users to make informed decisions quickly, enhancing productivity and accuracy in the underwriting process.

Transparent Underwriting Decisions

Sixfold emphasizes Transparency in Underwriting Decisions, providing full traceability for every decision made. This feature reassures compliance teams by eliminating the black box effect associated with many AI systems. Users can easily track inputs and outputs, ensuring accountability and fostering trust in the underwriting process.

Comprehensive Data Synthesis

Sixfold offers Comprehensive Data Synthesis, which simplifies complex data into easily understandable summaries. This key feature aids underwriters by presenting information in clear formats, highlighting discrepancies and risk signals. Users benefit from enhanced clarity, allowing for quick assessments and streamlined decision-making processes.

You may also like: