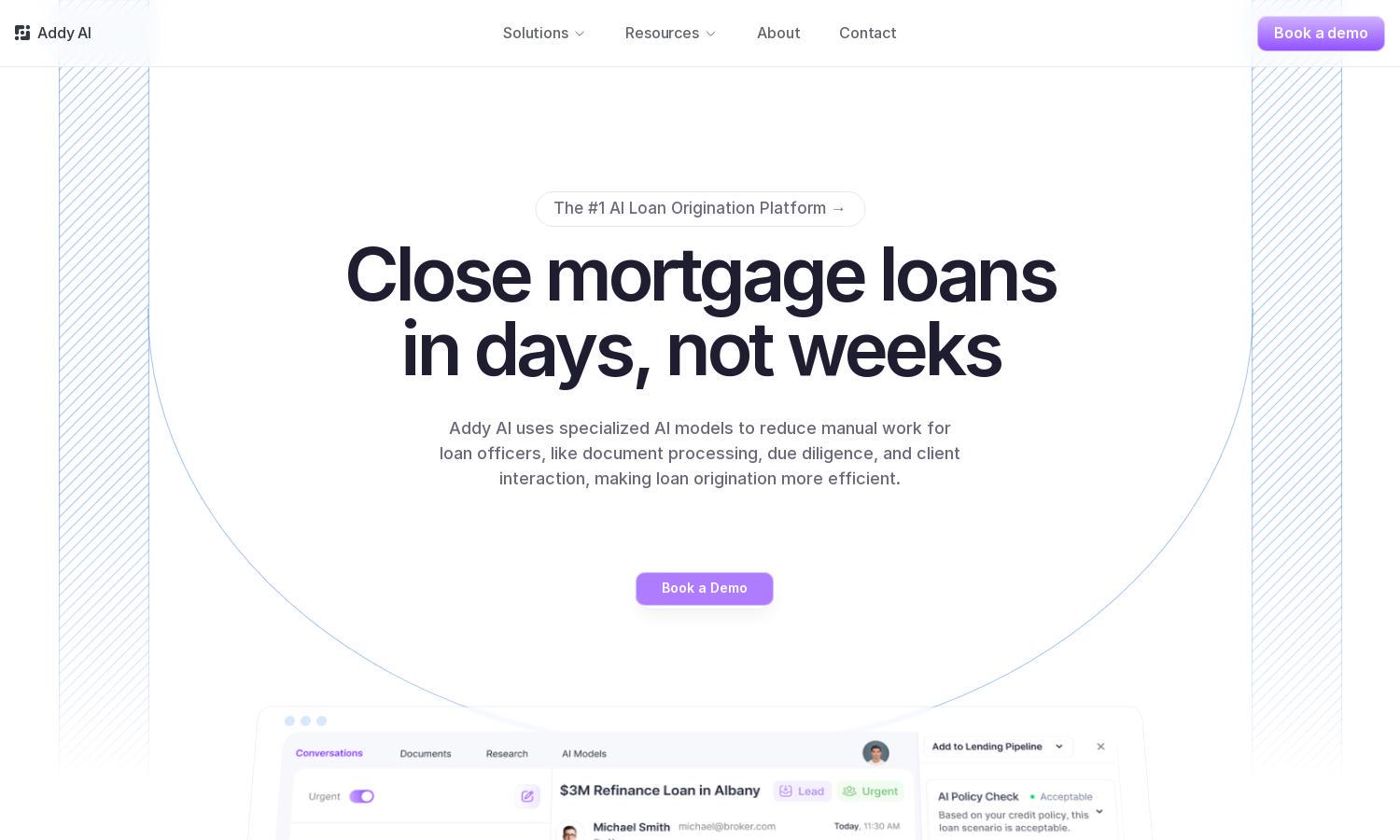

Addy AI

About Addy AI

Addy AI transforms mortgage lending by automating the loan origination process. Designed for lenders, it utilizes custom AI models to streamline workflows, significantly reducing manual tasks. This innovative platform ensures faster loan processing and improves client interaction, creating a seamless experience for borrowers and lenders alike.

Addy AI offers various pricing plans tailored for lenders, highlighting features like advanced AI models and CRM integration. Users gain enhanced productivity with every tier, and discounts are available for longer commitments. Upgrading unlocks additional benefits, streamlining the loan origination process even further.

The Addy AI interface is designed for seamless navigation, ensuring users can efficiently access essential features. Its intuitive layout enhances user experience, allowing quick integration with existing systems. Unique toolsets facilitate smooth documents processing, making Addy AI an indispensable asset for mortgage lenders.

How Addy AI works

Users begin by onboarding with Addy AI, linking their existing CRM and loan origination systems for seamless data integration. The user-friendly interface allows users to train custom AI models, automate document processing, and manage client interactions. With powerful tools for tracking and follow-ups, Addy AI ensures efficiency and enhances user experience throughout the loan origination process.

Key Features for Addy AI

Custom AI Model Training

Addy AI's custom AI model training feature uniquely allows lenders to tailor AI solutions to their needs. This enhances automation in the loan origination process, enables faster decision-making, and significantly reduces manual tasks, benefiting lenders by optimizing their operations and improving client interactions.

Instant Loan Assessment

Addy AI provides instant loan assessments, quickly checking if loans meet credit policies. This feature helps streamline the eligibility determination process, offering suggestions for borrowers to improve their chances of qualifying, thus saving time for loan officers and enhancing client satisfaction.

Document Processing Automation

The document processing automation feature of Addy AI revolutionizes how lenders handle paperwork. With state-of-the-art computer vision technology, it extracts essential loan data swiftly and accurately, minimizing manual errors and significantly speeding up the overall loan origination process for lenders.

You may also like: