TaxGPT

About TaxGPT

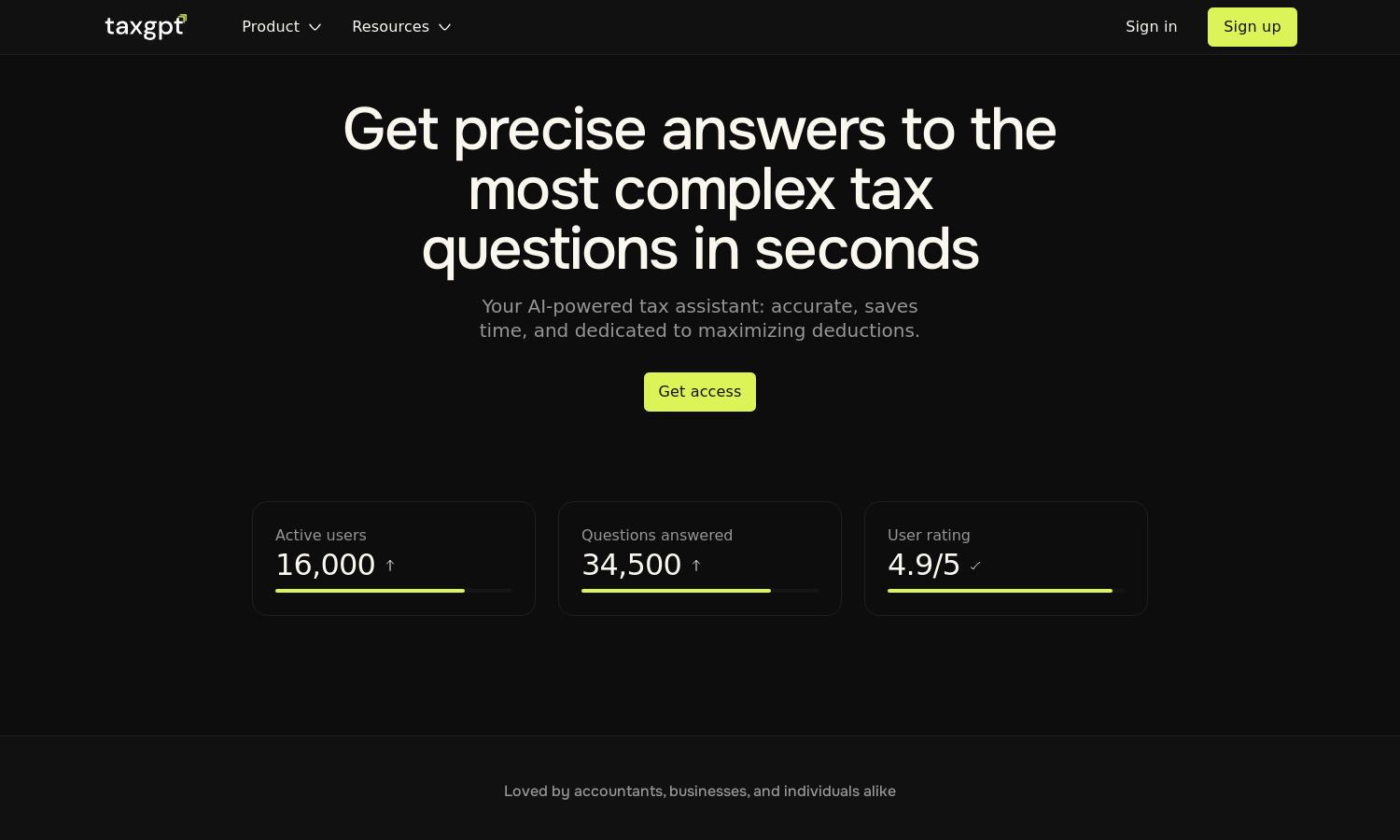

TaxGPT serves as an innovative AI-powered tax assistant for accountants and tax professionals. By integrating advanced AI algorithms, it offers secure, accurate, and instant answers to tax queries, thereby minimizing research time and maximizing deductions. TaxGPT streamlines operations, enhancing productivity and enabling informed decisions for its target audience.

TaxGPT offers a free 14-day trial, allowing users to explore its features without commitment. Detailed pricing tiers are designed to provide value for various user needs, ensuring they benefit from enhanced productivity and efficient tax processes. Upgrading unlocks advanced functionalities, tailored support, and superior performance for professionals.

TaxGPT’s user interface is designed for a seamless experience, featuring intuitive navigation and easy access to tools. The layout prioritizes user-friendliness, combining essential functions within a well-organized framework. Users can effortlessly interact with TaxGPT to streamline tax processes, making it straightforward and efficient for professionals.

How TaxGPT works

Users interact with TaxGPT by signing up for an account and going through a quick onboarding process. Once registered, they navigate the platform to access its AI-powered features. Users can ask complex tax questions, generate memos, or interact with the chatbot for instant responses. TaxGPT optimizes the tax assistance experience with secure operations and efficient workflows.

Key Features for TaxGPT

AI-Powered Tax Assistance

TaxGPT offers AI-powered tax assistance, ensuring that users receive accurate answers to their queries. This unique feature helps tax professionals streamline their workflows, significantly cut down research time, and improve overall productivity, making it an essential tool for effective tax management.

Integrated Client Portal

The integrated client portal in TaxGPT allows seamless document management and client interactions. This feature enhances user experience by simplifying communication and documentation processes, providing a more efficient and intuitive environment for tax professionals to serve their clients effectively.

Hallucination Control Algorithms

TaxGPT utilizes proprietary hallucination control algorithms, ensuring users get reliable, accurate responses to their tax inquiries. This distinct feature enhances user confidence, as it minimizes errors and provides substantial support in complex tax situations, making TaxGPT an invaluable resource for tax pros.

You may also like: