Chart

About Chart

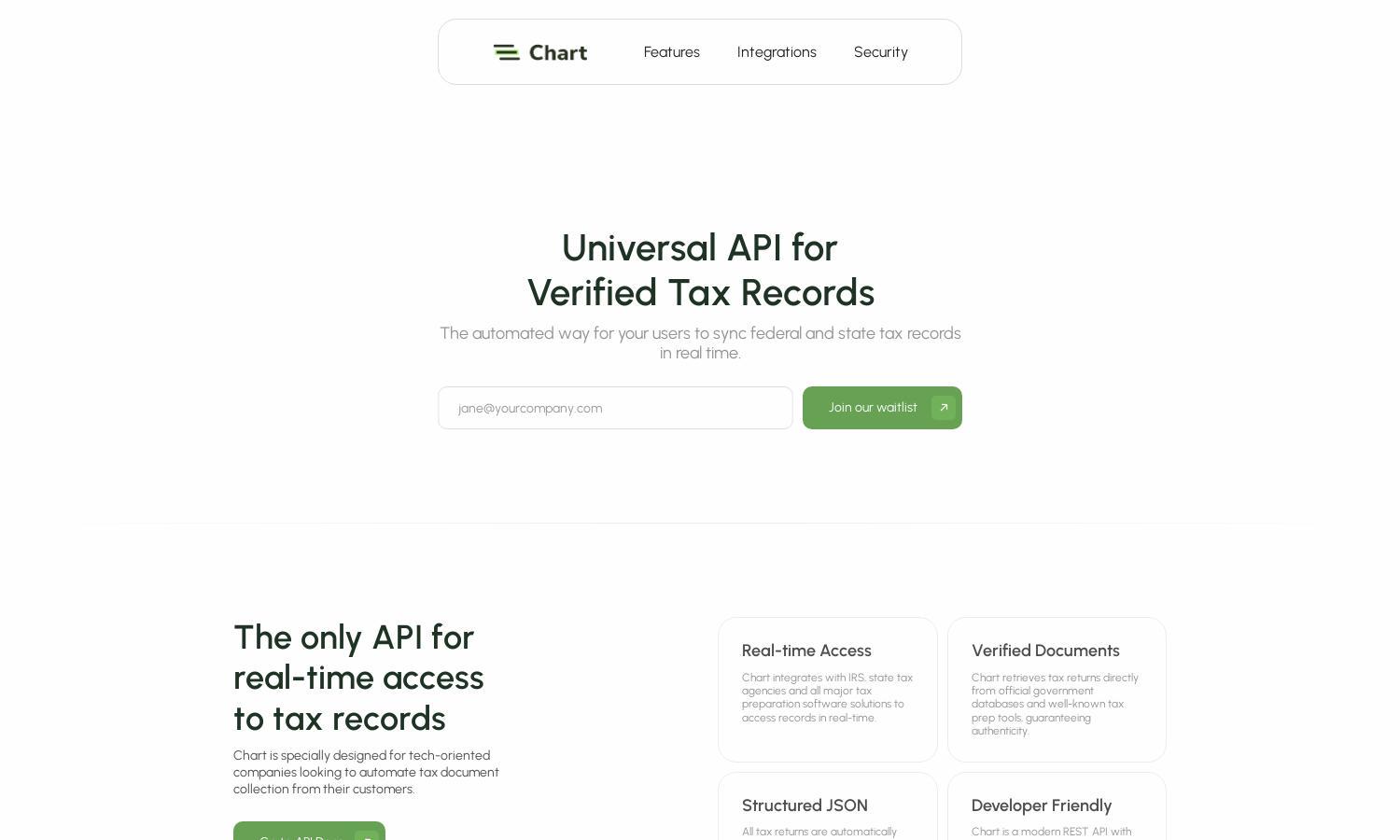

Chart provides a universal API tailored for tech-oriented companies, offering instant access to verified tax records. By integrating seamlessly with IRS and major tax software, it enables users to automate document collection, ensuring authenticity and security. Chart is ideal for businesses aiming to streamline tax data management.

Chart offers flexible pricing plans to suit different organizational needs. Users can choose from tiered subscriptions, with each plan providing increasing access to features and functionalities. Upgrading unlocks real-time tax record integrations, enhanced security options, and dedicated support, making it a great choice for scaling businesses.

Chart features a user-centric design that fosters seamless navigation and interaction. Its layout is carefully crafted to enhance user experience, with intuitive controls and easy access to essential features. This design approach ensures that users can efficiently manage tax document collection, making Chart both functional and user-friendly.

How Chart works

Users start by signing up for Chart, where they undergo an easy onboarding process that guides them through API integration options. Once set up, users can link their IRS and state accounts or upload PDFs directly. Chart processes these documents in real-time, providing verified tax records and a structured JSON output for easy use in applications.

Key Features for Chart

Real-time Tax Record Access

Chart's real-time tax record access is a standout feature, enabling users to retrieve verified federal and state tax documents instantly. This unique capability ensures that businesses can automate tax document collection, providing a seamless experience while guaranteeing the authenticity of the information obtained.

Multi-Submission Options

Chart empowers users with multiple submission options, allowing them to connect their IRS accounts, upload tax documents, or integrate with popular tax preparation software. This flexibility enhances the user experience, making it easier to collect accurate tax data while catering to varying user preferences and workflows.

Enterprise-grade Security

Chart prioritizes user security by implementing enterprise-grade protection measures. Unique to its offerings, Chart does not store user credentials, requiring re-login for every session. This commitment to security, combined with compliance with major frameworks, ensures that users can trust Chart with their sensitive tax information.

You may also like: